- Home

- Financial Terms

Financial Terms

ACCOUNT STATEMENT:

A document issued by the mutual fund, giving details of transactions and holdings of an investor.

A document issued by the mutual fund, giving details of transactions and holdings of an investor.

ADJUSTED NAV (TOTAL RETURN) :

The net asset value of a unit assuming reinvestment of distributions made to the investors in any form.

The net asset value of a unit assuming reinvestment of distributions made to the investors in any form.

ADVISOR:

Your financial consultant who gives professional advice on the fund's investments and who supervise the management of its assets.

Your financial consultant who gives professional advice on the fund's investments and who supervise the management of its assets.

AGE OF FUND :

The time elapsed since the launch of the fund.

The time elapsed since the launch of the fund.

ALPHA COEFFICIENT :

It is the excess return of the fund above risk adjusted market return, given its level of risk as measured by beta. An investment with a positive alpha indicates that the fund has performed better than expected, given its beta. And a negative alpha indicates that the fund has under performed.

It is the excess return of the fund above risk adjusted market return, given its level of risk as measured by beta. An investment with a positive alpha indicates that the fund has performed better than expected, given its beta. And a negative alpha indicates that the fund has under performed.

AMORTIZATION :

A method of equated monthly payments over the life of a loan. Payments usually are paid monthly but can be paid annually, quarterly, or on any other schedule. In the early part of a loan, repayment of interest is higher than that of principal. This relationship is reversed at the end of the loan.

A method of equated monthly payments over the life of a loan. Payments usually are paid monthly but can be paid annually, quarterly, or on any other schedule. In the early part of a loan, repayment of interest is higher than that of principal. This relationship is reversed at the end of the loan.

ANNUAL RETURN :

The percentage of change in net asset value over a year's time, assuming reinvestment of distribution such as dividend payment and bonuses.

The percentage of change in net asset value over a year's time, assuming reinvestment of distribution such as dividend payment and bonuses.

APPRECIATION :

When an investment increases in value, it appreciates. For example, a equity share whose price goes from Rs. 20/- to Rs. 25/- has appreciated by Rs. 5/-.

When an investment increases in value, it appreciates. For example, a equity share whose price goes from Rs. 20/- to Rs. 25/- has appreciated by Rs. 5/-.

APPLICATION FORM :

Form prescribed for investors to make applications for subscribing to the units of a fund.

Form prescribed for investors to make applications for subscribing to the units of a fund.

ARBITRAGE :

The practice of buying and selling an interlisted stock on different exchanges in order to profit from minute differences in price between the two markets.

The practice of buying and selling an interlisted stock on different exchanges in order to profit from minute differences in price between the two markets.

ASSET :

Property and resources, such as cash and investments, comprise a person's assets; i.e., anything that has value and can be traded. Examples include stocks, bonds, real estate, bank accounts, and jewellery.

Property and resources, such as cash and investments, comprise a person's assets; i.e., anything that has value and can be traded. Examples include stocks, bonds, real estate, bank accounts, and jewellery.

ASSET ALLOCATION :

When you divide your money among various types of investments, such as stocks, bonds, and short-term investments (also known as "instruments"), you are allocating your assets. The way in which your money is divided is called your asset allocation.

When you divide your money among various types of investments, such as stocks, bonds, and short-term investments (also known as "instruments"), you are allocating your assets. The way in which your money is divided is called your asset allocation.

ASSET MANAGEMENT COMPANY / AMC :

It is the investment manager for the mutual fund. It is a company set up primarily for managing the investment of mutual funds and makes investment decisions in accordance with the scheme objectives, deed of Trust and other provisions of the Investment Management Agreement.

It is the investment manager for the mutual fund. It is a company set up primarily for managing the investment of mutual funds and makes investment decisions in accordance with the scheme objectives, deed of Trust and other provisions of the Investment Management Agreement.

ASKED OR OFFERING PRICE :

The price at which a mutual fund's shares can be purchased. The asked or offering price means the current net asset value (NAV) per share plus sales charge, if any. For a no-load fund, the asked price is the same as the NAV.

The price at which a mutual fund's shares can be purchased. The asked or offering price means the current net asset value (NAV) per share plus sales charge, if any. For a no-load fund, the asked price is the same as the NAV.

ASSET ALLOCATION FUND :

A fund that spreads its portfolio among a wide variety of investments, including domestic and foreign stocks and bonds, government securities, gold bullion and real estate stocks. This gives small investors far more diversification than they could get allocating money on their own. Some of these funds keep the proportions allocated between different sectors relatively constant, while others alter the mix as market conditions change.

A fund that spreads its portfolio among a wide variety of investments, including domestic and foreign stocks and bonds, government securities, gold bullion and real estate stocks. This gives small investors far more diversification than they could get allocating money on their own. Some of these funds keep the proportions allocated between different sectors relatively constant, while others alter the mix as market conditions change.

AUTOMATIC INVESTMENT PLAN :

Under these plans, the investor mandates the mutual fund to allot fresh units at specified intervals (monthly, quarterly, etc.) against which the investor provides post-dated cheques. On the specified dates, the cheques are realized by the mutual fund and on realization, additional units are allotted to the investor at the prevailing NAV.

Under these plans, the investor mandates the mutual fund to allot fresh units at specified intervals (monthly, quarterly, etc.) against which the investor provides post-dated cheques. On the specified dates, the cheques are realized by the mutual fund and on realization, additional units are allotted to the investor at the prevailing NAV.

AUTOMATIC REINVESTMENT :

A service offered by most mutual funds whereby income, dividends and capital gain distributions are automatically invested into the fund by buying additional shares and thus building up holdings through the effects of compounding.

A service offered by most mutual funds whereby income, dividends and capital gain distributions are automatically invested into the fund by buying additional shares and thus building up holdings through the effects of compounding.

ANNUALISED RETURN :

This is the hypothetical rate of return, if the fund achieved it over a year's time, would produce the same cumulative total return if the fund performed consistently over the entire period. A total return is expressed in a percentage and tells you how much money you have earned or lost on an investment over time, assuming that all dividends and capital gains are reinvested.

This is the hypothetical rate of return, if the fund achieved it over a year's time, would produce the same cumulative total return if the fund performed consistently over the entire period. A total return is expressed in a percentage and tells you how much money you have earned or lost on an investment over time, assuming that all dividends and capital gains are reinvested.

AVERAGE COST METHOD :

A method of finding out the cost per unit by adding up all the costs involved in purchasing all the units of investment and then dividing the sum by the total number of units.

A method of finding out the cost per unit by adding up all the costs involved in purchasing all the units of investment and then dividing the sum by the total number of units.

AVERAGE CREDIT QUALITY :

The composite indicator of the credit quality of the Scheme's portfolios. It is an average of each debt instrument's credit rating, weighted by the instruments relative weight in the portfolio. For these calculations, Government of India securities, cash and call money instruments are taken as AAA credit quality and non-rated debt instruments are taken as having BBB credit quality.

The composite indicator of the credit quality of the Scheme's portfolios. It is an average of each debt instrument's credit rating, weighted by the instruments relative weight in the portfolio. For these calculations, Government of India securities, cash and call money instruments are taken as AAA credit quality and non-rated debt instruments are taken as having BBB credit quality.

BACK END LOAD :

The difference between the NAV of the units of a scheme and the price at which they are redeemed. The difference is charged by the fund.

The difference between the NAV of the units of a scheme and the price at which they are redeemed. The difference is charged by the fund.

BALANCE SHEET :

A financial statement showing the nature and amount of a company's assets, liabilities and shareholders' equity.

A financial statement showing the nature and amount of a company's assets, liabilities and shareholders' equity.

BALANCED FUND :

A mutual fund that maintains a balanced portfolio, generally 40% bonds and 60% equity.

A mutual fund that maintains a balanced portfolio, generally 40% bonds and 60% equity.

BALANCE MATURITY TENURE OF A SCHEME

:

In the case of close-ended schemes, the balance period till the redemption of the scheme.

In the case of close-ended schemes, the balance period till the redemption of the scheme.

BARTER :

The exchange of goods and services for other goods and services without the use of money.

The exchange of goods and services for other goods and services without the use of money.

BASIS POINT :

A phrase used to describe differences in bond yields, with one basis point representing one-hundredth of a percentage point. Thus if Bond X yields 8.5 per cent and Bond Y 8.75 per cent, the difference is 25 basis points.

A phrase used to describe differences in bond yields, with one basis point representing one-hundredth of a percentage point. Thus if Bond X yields 8.5 per cent and Bond Y 8.75 per cent, the difference is 25 basis points.

BEAR MARKET :

Period during which investors are on a selling spree and the share prices are going down.

Period during which investors are on a selling spree and the share prices are going down.

BENCHMARK :

A parameter with which a scheme can be compared. For example, the performance of a scheme can be benchmarked against an appropriate index.

A parameter with which a scheme can be compared. For example, the performance of a scheme can be benchmarked against an appropriate index.

BETA :

A measure of the relative sensitivity of a stock or mutual fund to the market. The higher the beta, the more volatile (or more sensitive) the stock or fund is considered to be relative to the market as a whole. The BSE sensex is assigned a beta of 1.

A measure of the relative sensitivity of a stock or mutual fund to the market. The higher the beta, the more volatile (or more sensitive) the stock or fund is considered to be relative to the market as a whole. The BSE sensex is assigned a beta of 1.

BID OR SELL PRICE :

The price at which a mutual fund's shares are redeemed (bought back) by the fund. The bid or redemption price means the current net asset value per share, less any redemption fee or back-end load.

The price at which a mutual fund's shares are redeemed (bought back) by the fund. The bid or redemption price means the current net asset value per share, less any redemption fee or back-end load.

BLUE CHIP :

A share in a large, safe, prestigious company, of the highest class among stock market investments. A blue-chip company would be called thus by being well-known, having a large paid-up capital, a good track record of dividend payments and skilled management.

A share in a large, safe, prestigious company, of the highest class among stock market investments. A blue-chip company would be called thus by being well-known, having a large paid-up capital, a good track record of dividend payments and skilled management.

BOARD OF DIRECTORS :

A committee elected by the shareholders of a company, empowered to act on their behalf in the management of company affairs. Directors are normally elected each year at the annual meeting.

A committee elected by the shareholders of a company, empowered to act on their behalf in the management of company affairs. Directors are normally elected each year at the annual meeting.

BOND :

An interest-bearing promise to pay a specified sum of money -- the principal amount -- due on a specific date.

An interest-bearing promise to pay a specified sum of money -- the principal amount -- due on a specific date.

BOND FUNDS :

Registered investment companies whose assets are invested in diversified portfolios of bonds primarily fixed income securities.

Registered investment companies whose assets are invested in diversified portfolios of bonds primarily fixed income securities.

BOND RATING :

System of evaluating the probability of whether a bond issuer will default. CRISIL, ICRA, CARE and other rating agencies analyze the financial stability of both corporate and state government debt issuers. Ratings range from AAA (extremely unlikely to default) to D (likely to default). Mutual funds generally restrict their bond purchases to issues of certain quality ratings, which are specified in their prospectus.

System of evaluating the probability of whether a bond issuer will default. CRISIL, ICRA, CARE and other rating agencies analyze the financial stability of both corporate and state government debt issuers. Ratings range from AAA (extremely unlikely to default) to D (likely to default). Mutual funds generally restrict their bond purchases to issues of certain quality ratings, which are specified in their prospectus.

BONUS :

Additional units allotted to investors on the basis of their existing holdings. Basically, there is a split of existing units into more than one unit resulting in the reduction of the NAV per unit.

Additional units allotted to investors on the basis of their existing holdings. Basically, there is a split of existing units into more than one unit resulting in the reduction of the NAV per unit.

BROKER :

One who guides the investors on one or more investments and facilitates the process of investment. A broker is a member of a recognized stock exchange who buys and sells or otherwise deals in securities.

One who guides the investors on one or more investments and facilitates the process of investment. A broker is a member of a recognized stock exchange who buys and sells or otherwise deals in securities.

BROKERAGE :

The fee payable to a broker for acting as an intermediary in a transaction. For example, brokerage is payable by a fund for getting fresh investments from investors.

The fee payable to a broker for acting as an intermediary in a transaction. For example, brokerage is payable by a fund for getting fresh investments from investors.

BSE INDEX :

A index reflecting the stock prices of 30 companies listed on the Bombay Stock Exchange (BSE) which is taken to be representative of the stock market movement.

A index reflecting the stock prices of 30 companies listed on the Bombay Stock Exchange (BSE) which is taken to be representative of the stock market movement.

BULL MARKET :

Period during which the prices of stocks in the stock market keep continuously rising for a significant period of time on the back of sustained demand for the stocks.

Period during which the prices of stocks in the stock market keep continuously rising for a significant period of time on the back of sustained demand for the stocks.

CAPITAL :

This is the amount of money you have invested. When your investing objective is capital preservation, your priority is trying not to lose any money. When your investing objective is capital growth, your priority is trying to make your initial investment grow in value.

This is the amount of money you have invested. When your investing objective is capital preservation, your priority is trying not to lose any money. When your investing objective is capital growth, your priority is trying to make your initial investment grow in value.

CAPITAL APPRECIATION :

As the value of the securities in a portfolio increases, a fund's Net Asset Value (NAV) increases, meaning that the value of your investment rises. If you sell units at a higher price than you paid for them, you make a profit, or capital gain. If you sell units at a lower price than you paid for them, you'll have a capital loss.

As the value of the securities in a portfolio increases, a fund's Net Asset Value (NAV) increases, meaning that the value of your investment rises. If you sell units at a higher price than you paid for them, you make a profit, or capital gain. If you sell units at a lower price than you paid for them, you'll have a capital loss.

CAPITAL APPRECIATION FUND :

A mutual fund that seeks maximum capital appreciation through the use of investment techniques involving greater than ordinary risk, such as borrowing money in order to provide leverage and high portfolio turnover.

A mutual fund that seeks maximum capital appreciation through the use of investment techniques involving greater than ordinary risk, such as borrowing money in order to provide leverage and high portfolio turnover.

CAPITAL GAINS :

The difference between an asset's purchased price and selling price, when the difference is positive. A capital loss would be when the difference between an asset's purchase price and selling price is negative.

The difference between an asset's purchased price and selling price, when the difference is positive. A capital loss would be when the difference between an asset's purchase price and selling price is negative.

CAPITAL GAINS DISTRIBUTERS :

Payments (usually annually) to mutual fund shareholders of gains realized on the sale of portfolio securities.

Payments (usually annually) to mutual fund shareholders of gains realized on the sale of portfolio securities.

CAPITAL GROWTH :

A rise in market value of a mutual fund's securities, reflected in its NAV per share. This is a specific long-term objective of many mutual funds. Capital Loss realized when an instrument or asset is sold at a price below its cost.

A rise in market value of a mutual fund's securities, reflected in its NAV per share. This is a specific long-term objective of many mutual funds. Capital Loss realized when an instrument or asset is sold at a price below its cost.

CAPITAL MARKET :

The market where capital funds, debt (bonds) and equity ( stocks) are traded.

The market where capital funds, debt (bonds) and equity ( stocks) are traded.

CASH & OTHER CATEGORY :

A mutual fund asset allocation theory that includes net cash, short-term securities, and any other securities (such as options) not included in other asset allocation categories.

A mutual fund asset allocation theory that includes net cash, short-term securities, and any other securities (such as options) not included in other asset allocation categories.

CALLABLE BOND :

A bond which the issuer is permitted or required to redeem before the stated maturity date at a specified price, usually at or above par, by giving notice of redemption in a manner specified in the bond contract.

A bond which the issuer is permitted or required to redeem before the stated maturity date at a specified price, usually at or above par, by giving notice of redemption in a manner specified in the bond contract.

CDSC :

Contingent Deferred Sales Charge (CDSC), a charge imposed when the units are redeemed within the first four years of unit ownership. The SEBI (Mutual Funds) Regulations, 1996, direct that a CDSC may be charged only for the first four years after purchase and mandates the maximum amount that can be charged in each year.

Contingent Deferred Sales Charge (CDSC), a charge imposed when the units are redeemed within the first four years of unit ownership. The SEBI (Mutual Funds) Regulations, 1996, direct that a CDSC may be charged only for the first four years after purchase and mandates the maximum amount that can be charged in each year.

CERTIFICATE OF DEPOSIT :

Interest-bearing, short-term debt instrument mainly issued by Financial institutions

Interest-bearing, short-term debt instrument mainly issued by Financial institutions

CLOSED-ENDED MUTUAL FUND :

A mutual fund that offers a limited number of shares. They are traded in the securities markets. Price is determined by supply and demand. Unlike open-ended mutual funds, closed-ended funds do not redeem their shares.

A mutual fund that offers a limited number of shares. They are traded in the securities markets. Price is determined by supply and demand. Unlike open-ended mutual funds, closed-ended funds do not redeem their shares.

COLLATERAL SECURITY :

This is extra security provided by a borrower to back up his/her intention to repay a loan.

This is extra security provided by a borrower to back up his/her intention to repay a loan.

COMMON STOCKS :

Stocks represent a share in the ownership of a particular company. If the company does well, the value of each share generally goes up. Although common stocks have a history of long-term growth, their prices fluctuate based on changes in a company's financial condition and on overall market and economic conditions.

Stocks represent a share in the ownership of a particular company. If the company does well, the value of each share generally goes up. Although common stocks have a history of long-term growth, their prices fluctuate based on changes in a company's financial condition and on overall market and economic conditions.

COMMERCIAL PAPER :

Short-term, unsecured promissory notes with maturities shorter than 3 months. They are issued by corporations to fund short-term credit needs.

Short-term, unsecured promissory notes with maturities shorter than 3 months. They are issued by corporations to fund short-term credit needs.

COMMISSION :

The broker's or agent's fee for buying or selling securities for a client. The fee is usually based on a percentage of the transaction's market value.

The broker's or agent's fee for buying or selling securities for a client. The fee is usually based on a percentage of the transaction's market value.

COMPLIANCE OFFICER :

Officer appointed by the AMC to comply with regulatory requirement and to redress investor.

Officer appointed by the AMC to comply with regulatory requirement and to redress investor.

COMPOUNDING :

When you deposit money in a bank, it earns interest. When that interest also begins to earn interest, the result is compound interest. Compounding occurs if bond income or dividends from stocks or mutual funds are reinvested. Because of compounding, money has the potential to grow much faster.

When you deposit money in a bank, it earns interest. When that interest also begins to earn interest, the result is compound interest. Compounding occurs if bond income or dividends from stocks or mutual funds are reinvested. Because of compounding, money has the potential to grow much faster.

CONSIDERATION :

The 'consideration' is the total purchase or sale amount associated with a transaction. The amount you 'pay' or 'receive'. It may also be the basis for working out the commission, taxes and any other charges you are asked to pay.

The 'consideration' is the total purchase or sale amount associated with a transaction. The amount you 'pay' or 'receive'. It may also be the basis for working out the commission, taxes and any other charges you are asked to pay.

CONTINUOUS OFFER :

Offer of the Units when the Scheme becomes open ended, after closure of the initial offer. The Scheme became open ended on January 1, 1998.

Offer of the Units when the Scheme becomes open ended, after closure of the initial offer. The Scheme became open ended on January 1, 1998.

CONVERTIBLE BOND :

A corporate bond, usually a junior subordinated debenture, which can be exchanged for shares of the issuer's common stock.

A corporate bond, usually a junior subordinated debenture, which can be exchanged for shares of the issuer's common stock.

CONVEXITY :

A mathematical concept that measures the sensitivity of the market price of interest- bearing bonds to changes in interest rate levels. See also Duration.

A mathematical concept that measures the sensitivity of the market price of interest- bearing bonds to changes in interest rate levels. See also Duration.

CORPUS :

The total amount of money invested by all the investors in a scheme

The total amount of money invested by all the investors in a scheme

CORRELATION MEASURES :

Measures that show the validity of a comparison to a benchmark index based on the historical relationship between portfolio returns and index returns. See R"2". See also Volatility Measures.

Measures that show the validity of a comparison to a benchmark index based on the historical relationship between portfolio returns and index returns. See R"2". See also Volatility Measures.

COST OF CHURNING/TURNOVER COST :

The portfolio of a scheme changes from time to time. The rate of change depends on the style of the fund manager. Such portfolio changes have associated costs of brokerage, custody fees, transaction fees and registration fees, which lower the returns. These costs comprise the cost of churning.

The portfolio of a scheme changes from time to time. The rate of change depends on the style of the fund manager. Such portfolio changes have associated costs of brokerage, custody fees, transaction fees and registration fees, which lower the returns. These costs comprise the cost of churning.

COUPON :

The term is used colloquially to refer to a security's interest rate.

The term is used colloquially to refer to a security's interest rate.

COUPON RATE :

The annual rate of interest payable on a debt security expressed as a percentage of the principal amount.

The annual rate of interest payable on a debt security expressed as a percentage of the principal amount.

CURRENCY FLUCTUATION :

Changes in the value of a currency in relationship to other major currencies. Currency fluctuations can have a significant effect on the value of international mutual funds.

Changes in the value of a currency in relationship to other major currencies. Currency fluctuations can have a significant effect on the value of international mutual funds.

CURRENCY RISK :

The risk that shifts in foreign exchange rates may undermine the dollar or any other foreign currency value of overseas investments.

The risk that shifts in foreign exchange rates may undermine the dollar or any other foreign currency value of overseas investments.

CURRENT INCOME :

Monies paid during the period an investment is held. Examples include bond interest and stock dividends.

Monies paid during the period an investment is held. Examples include bond interest and stock dividends.

CURRENT LOAD :

Load structure applicable currently. Funds keep revising the load structures from time to time.

Load structure applicable currently. Funds keep revising the load structures from time to time.

CURRENT MARKET VALUE :

The amount a willing buyer will pay for a bond today, which may be at a premium (above face value) or a discount (below face value).

The amount a willing buyer will pay for a bond today, which may be at a premium (above face value) or a discount (below face value).

CURRENT YIELD :

The ration of interest to the actual market price of the bond stated as a percentage

The ration of interest to the actual market price of the bond stated as a percentage

CUSTODIAN :

The bank or trust company that maintains a mutual fund's assets, including its portfolio of securities or some record of them. Provides safekeeping of securities but has no role in portfolio management.

The bank or trust company that maintains a mutual fund's assets, including its portfolio of securities or some record of them. Provides safekeeping of securities but has no role in portfolio management.

CUT OFF TIME :

In respect of all mutual funds regulated by SEBI, fresh subscriptions and redemptions are processed at a particular NAV. Every fund specifies a cut-off time in respect of fresh subscriptions and redemption of units. All requests received before the cut-off times are processed at that day's NAV and thereafter at the next day's NAV.

In respect of all mutual funds regulated by SEBI, fresh subscriptions and redemptions are processed at a particular NAV. Every fund specifies a cut-off time in respect of fresh subscriptions and redemption of units. All requests received before the cut-off times are processed at that day's NAV and thereafter at the next day's NAV.

DATE OF REDEMPTION :

The date specified for the redemption of a scheme. No such date is specified for an open-ended scheme.

The date specified for the redemption of a scheme. No such date is specified for an open-ended scheme.

DEBT /INCOME FUNDS :

Funds that invest in income bearing instruments such as corporate debentures, PSU bonds, gilts, treasury bills, certificates of deposit and commercial papers. Although these funds are less volatile, the underlying investments carry a credit risk. Comparatively, these funds are the least risky and are preferred by risk-averse investors.

Funds that invest in income bearing instruments such as corporate debentures, PSU bonds, gilts, treasury bills, certificates of deposit and commercial papers. Although these funds are less volatile, the underlying investments carry a credit risk. Comparatively, these funds are the least risky and are preferred by risk-averse investors.

DEFICIT :

The shortfall between government revenues and budgetary spending in any given year. A surplus occurs when annual revenues exceed expenditures.

The shortfall between government revenues and budgetary spending in any given year. A surplus occurs when annual revenues exceed expenditures.

DERIVATIVE :

An investment contract based on an underlying investment called an "instrument." The most common type of derivative is an option contract, which involves the right to buy or sell the underlying instrument at an agreed price. Futures contracts are also derivatives.

An investment contract based on an underlying investment called an "instrument." The most common type of derivative is an option contract, which involves the right to buy or sell the underlying instrument at an agreed price. Futures contracts are also derivatives.

DESIGNATED INVESTOR SERVICE CENTRES

:

Any location, as may be defined by the Asset Management Company from time to time, where investors can tender the request for subscription, redemption, switching of units, or any other request.

Any location, as may be defined by the Asset Management Company from time to time, where investors can tender the request for subscription, redemption, switching of units, or any other request.

DEPOSITORY :

Depository as defined in the Depositories Act, 1996 (22 of 1996).

Depository as defined in the Depositories Act, 1996 (22 of 1996).

DIVERSIFICATION :

Diversification is the concept of spreading your money across different types of investments and/or issuers to potentially moderate your investment risk.

Diversification is the concept of spreading your money across different types of investments and/or issuers to potentially moderate your investment risk.

DIVIDEND :

Income distributed by the Scheme on the Units.

Income distributed by the Scheme on the Units.

DIVIDEND DISTRIBUTION TAX :

A tax payable by a debt oriented mutual fund (a mutual fund that invests more than 50% of its portfolio in the debt market) before dividend is distributed to the unit holders. The current Dividend Distribution Tax is 20% plus the 10% surcharge .

A tax payable by a debt oriented mutual fund (a mutual fund that invests more than 50% of its portfolio in the debt market) before dividend is distributed to the unit holders. The current Dividend Distribution Tax is 20% plus the 10% surcharge .

DIVIDEND FREQUENCY :

The periodicity of dividend payout of a scheme. This is especially valid in the case of an income/debt scheme.

The periodicity of dividend payout of a scheme. This is especially valid in the case of an income/debt scheme.

DIVIDEND HISTORY :

The track record of dividends declared by a fund till date.

The track record of dividends declared by a fund till date.

DIVIDEND PER UNIT :

Total amount of dividend declared by a fund for a scheme divided by total number of units issued to all the investors.

Total amount of dividend declared by a fund for a scheme divided by total number of units issued to all the investors.

DIVIDEND PERIOD :

The period for which the dividend is declared.

The period for which the dividend is declared.

DIVIDEND PLAN :

In a dividend plan, the fund pays dividend from time to time as and when the dividend is declared.

In a dividend plan, the fund pays dividend from time to time as and when the dividend is declared.

DIVIDEND REINVESTMENT :

In a dividend reinvestment plan, the dividend is reinvested in the scheme itself. Hence instead of receiving dividend, the unit holders receive units. Thus the number of units allotted under the dividend reinvestment plan would be the dividend declared divided by the ex-dividend NAV.

In a dividend reinvestment plan, the dividend is reinvested in the scheme itself. Hence instead of receiving dividend, the unit holders receive units. Thus the number of units allotted under the dividend reinvestment plan would be the dividend declared divided by the ex-dividend NAV.

DIVIDEND WARRANT :

An instrument issued by companies/ mutual funds to an investor for the purpose of payment of dividends.

An instrument issued by companies/ mutual funds to an investor for the purpose of payment of dividends.

DIVIDEND YIELD :

The dividend earned per unit of a scheme at the prevailing per unit price.

The dividend earned per unit of a scheme at the prevailing per unit price.

DURATION :

Duration estimates how much a bond's price fluctuates with changes in comparable interest rates. If rates rise 1.00%, for example, a fund with a 5-year duration is likely to lose about 5.00% of its value. Other factors also can influence a bond fund's performance and share price. A bond fund's actual performance may differ.

Duration estimates how much a bond's price fluctuates with changes in comparable interest rates. If rates rise 1.00%, for example, a fund with a 5-year duration is likely to lose about 5.00% of its value. Other factors also can influence a bond fund's performance and share price. A bond fund's actual performance may differ.

ENDORSEMENT :

Assigning or transferring a lien to another person is accomplished through the use of an endorsement. The words "PAY TO THE ORDER OF" and then the name of the person to whom the lien is being assigned to, is written. If there is not enough space on the original note to write an endorsement, it is written on a separate piece of paper that is permanently affixed to the original note. This is called an allonge.

Assigning or transferring a lien to another person is accomplished through the use of an endorsement. The words "PAY TO THE ORDER OF" and then the name of the person to whom the lien is being assigned to, is written. If there is not enough space on the original note to write an endorsement, it is written on a separate piece of paper that is permanently affixed to the original note. This is called an allonge.

ENTRY LOAD :

Load on purchases/ switch-out of units.

Load on purchases/ switch-out of units.

EQUITY SCHEMES :

Schemes where more than 50% of the investments are done in equity shares of various companies. The objective is to provide capital appreciation over a period of time.

Schemes where more than 50% of the investments are done in equity shares of various companies. The objective is to provide capital appreciation over a period of time.

EXCHANGE PRIVILEDGE :

The right to transfer investments from one fund into another, generally within the same fund group, at nominal cost.

The right to transfer investments from one fund into another, generally within the same fund group, at nominal cost.

EXCHANGE RATE :

The price at which one currency trades for another.

The price at which one currency trades for another.

EX-DIVIDEND RATE :

The day that a fund's Board of Directors declares the amount of income or capital gain to be distributed to shareholders and deducts that amount from the fund's net asset value.

The day that a fund's Board of Directors declares the amount of income or capital gain to be distributed to shareholders and deducts that amount from the fund's net asset value.

EXPENSE RATIO :

Annual percentage of fund's assets that is paid out in expenses. Expenses include management fees and all the fees associated with the fund's daily operations.

Annual percentage of fund's assets that is paid out in expenses. Expenses include management fees and all the fees associated with the fund's daily operations.

EXIT LOAD :

Load on redemptions Dividend switch-out of units

Load on redemptions Dividend switch-out of units

FACE VALUE :

The face value is the term used to describe the value of a bond in terms of what the company which issued the bond will actually repay when the loan matures. It's sometimes described as nominal or par value.

The face value is the term used to describe the value of a bond in terms of what the company which issued the bond will actually repay when the loan matures. It's sometimes described as nominal or par value.

FII :

Foreign Institutional Investors, registered with SEBI under the Securities and Exchange Board of India (Foreign Institutional Investors) Regulations, 1995.

Foreign Institutional Investors, registered with SEBI under the Securities and Exchange Board of India (Foreign Institutional Investors) Regulations, 1995.

FISCAL YEAR :

An accounting period consisting of 12 consecutive months. FUND A mutual fund is a trust under the Indian Trust Act. Each fund manages one or more schemes.

An accounting period consisting of 12 consecutive months. FUND A mutual fund is a trust under the Indian Trust Act. Each fund manages one or more schemes.

FUND CATEGORY :

Classification of a scheme depending on the type of assets in which the mutual fund company invests the corpus. It could be a growth, debt, balanced, gilt or liquid scheme.

Classification of a scheme depending on the type of assets in which the mutual fund company invests the corpus. It could be a growth, debt, balanced, gilt or liquid scheme.

FUND FAMILY :

All the schemes, which are managed by one mutual fund.

All the schemes, which are managed by one mutual fund.

FUND MANAGEMENT COSTS :

The charge levied by an AMC on a mutual fund for managing their funds.

The charge levied by an AMC on a mutual fund for managing their funds.

FUND MANAGER :

The person who makes all the final decisions regarding investments of a scheme

The person who makes all the final decisions regarding investments of a scheme

GILT FUNDS :

Funds, which invest only in government securities of different maturities. With virtually no default risk, they are very secure. While returns are steady and secure, they are lower than those from other debt funds.

Funds, which invest only in government securities of different maturities. With virtually no default risk, they are very secure. While returns are steady and secure, they are lower than those from other debt funds.

GROWTH :

Fund's Growth funds are designed to pursue capital appreciation over the long-term. Some growth funds are broad-based, meaning that they have a wide range of stocks and industries in which they can invest. Others have a narrower focus - for example, they may invest in a particular type of stock, such as small-cap or cyclical stocks, or use a specialized approach to stock selection, such as investing only in stocks that are currently underpriced. Growth funds are more volatile than more conservative income or money market funds and generally reflect changes in market conditions and other company, political, and economic news.

Fund's Growth funds are designed to pursue capital appreciation over the long-term. Some growth funds are broad-based, meaning that they have a wide range of stocks and industries in which they can invest. Others have a narrower focus - for example, they may invest in a particular type of stock, such as small-cap or cyclical stocks, or use a specialized approach to stock selection, such as investing only in stocks that are currently underpriced. Growth funds are more volatile than more conservative income or money market funds and generally reflect changes in market conditions and other company, political, and economic news.

GROWTH FUND :

A mutual fund whose primary investment objective is long-term growth of capital. It invests principally in common stocks with significant growth potential. Growth Stocks of companies that have shown or are expected to show rapid earnings and revenue growth. Growth stocks have relatively more risk than other conventional forms of investment.

A mutual fund whose primary investment objective is long-term growth of capital. It invests principally in common stocks with significant growth potential. Growth Stocks of companies that have shown or are expected to show rapid earnings and revenue growth. Growth stocks have relatively more risk than other conventional forms of investment.

Hybrid Funds :

One can avail ready-made diversified products in mutual funds through hybrid funds. Within hybrid funds, some invest predominantly in equity or debt while there are some which dynamically allocate between equity and debt based on market conditions or a mathematical model.

One can avail ready-made diversified products in mutual funds through hybrid funds. Within hybrid funds, some invest predominantly in equity or debt while there are some which dynamically allocate between equity and debt based on market conditions or a mathematical model.

INCOME FUND :

A mutual fund that primarily seeks current income rather than growth of capital. It will tend to invest in stocks and bonds that normally pay high dividends and interest.

A mutual fund that primarily seeks current income rather than growth of capital. It will tend to invest in stocks and bonds that normally pay high dividends and interest.

INDEX FUND :

A passively managed, limited-expense (advisor fee no higher than 0.50%) fund designed to replicate the performance of an unmanaged stock index on a reinvested basis.

A passively managed, limited-expense (advisor fee no higher than 0.50%) fund designed to replicate the performance of an unmanaged stock index on a reinvested basis.

INFLATION :

When the price of goods and services rises, the result is called inflation. This means that things you buy today at one price are likely to cost more in the future.

When the price of goods and services rises, the result is called inflation. This means that things you buy today at one price are likely to cost more in the future.

INFLATION RISK :

The chance that the value of assets or income will be diminished as inflation shrinks the value of a currency.

The chance that the value of assets or income will be diminished as inflation shrinks the value of a currency.

INITIAL PUBLIC OFFERING (IPO)/ INITIAL

ISSUE :

The first sale of stock by a private company to the public. IPO’s are often issued by smaller, younger companies seeking capital to expand, but can also be done by large privately-owned companies looking to become publicly traded.

In an IPO, the issuer obtains the assistance of an underwriting firm, which helps it determine what type of security to issue (common or preferred), best offering price and time to bring it to market. Also referred to as a "public offering".

The first sale of stock by a private company to the public. IPO’s are often issued by smaller, younger companies seeking capital to expand, but can also be done by large privately-owned companies looking to become publicly traded.

In an IPO, the issuer obtains the assistance of an underwriting firm, which helps it determine what type of security to issue (common or preferred), best offering price and time to bring it to market. Also referred to as a "public offering".

INITIAL OFFER PRICE :

The price at which units of a scheme are offered in its Initial Public Offer (IPO).

The price at which units of a scheme are offered in its Initial Public Offer (IPO).

INITIAL OFFER PERIOD :

The dates on or the period during which the initial subscription to units of the Scheme can be made.

The dates on or the period during which the initial subscription to units of the Scheme can be made.

INSTITUTUONAL INVESTOR :

An institutional investor is a professional money manager whose job it is to put money into shares and other assets on behalf of private investors who entrust them with money via their pension and life insurance funds.

An institutional investor is a professional money manager whose job it is to put money into shares and other assets on behalf of private investors who entrust them with money via their pension and life insurance funds.

INTEREST :

The amount paid by a borrower as compensation for the use of borrowed money. This amount is generally expressed as an annual percentage of the principal amount.

The amount paid by a borrower as compensation for the use of borrowed money. This amount is generally expressed as an annual percentage of the principal amount.

INTEREST RATE :

The annual rate, expressed as a percentage of principal, payable for use of borrowed money.

The annual rate, expressed as a percentage of principal, payable for use of borrowed money.

INTERNATIONAL FUNDS / EMERGING MARKET

FUNDS :

Funds investing in assets or bonds/shares of companies from emerging economies. These are not permissible in India due to regulations against investing abroad. Most of the schemes of Foreign Institutional Investors (FII's) investing in India are funds of this type.

Funds investing in assets or bonds/shares of companies from emerging economies. These are not permissible in India due to regulations against investing abroad. Most of the schemes of Foreign Institutional Investors (FII's) investing in India are funds of this type.

IN THE MONEY SECURITIES :

An option contract on a stock whose current market price is above the striking price of a call option or below the striking price of a put option. For example, a call option on ABC fund at a striking price of 100 would be "in the money" if ABC fund were selling at 10"2", and a put option with the same striking price would be "in the money" if ABC were selling at 98.

An option contract on a stock whose current market price is above the striking price of a call option or below the striking price of a put option. For example, a call option on ABC fund at a striking price of 100 would be "in the money" if ABC fund were selling at 10"2", and a put option with the same striking price would be "in the money" if ABC were selling at 98.

INVESTMENT GRADE OR INVESTMENT GRADE BOND

:

The broad credit designation given to corporate and municipal bonds which have a high probability of being paid and minor, if any, speculative features. Bonds rated Baa and higher by Moody's Investors Service or BBB and higher by Standard & Poor's are deemed by those agencies to be "investment grade."

The broad credit designation given to corporate and municipal bonds which have a high probability of being paid and minor, if any, speculative features. Bonds rated Baa and higher by Moody's Investors Service or BBB and higher by Standard & Poor's are deemed by those agencies to be "investment grade."

INVESTMENT OBJECTIVE :

The identification of attributes associated with an investment or investment strategy, designed to isolate and compare risks, define acceptable levels of risk, and match investments with personal goals.

The identification of attributes associated with an investment or investment strategy, designed to isolate and compare risks, define acceptable levels of risk, and match investments with personal goals.

ISSUE DATE :

The date on which a security is deemed to be issued or originated.

The date on which a security is deemed to be issued or originated.

ISSUER :

A state, political subdivision, agency or authority that borrows money through the sale of bonds or notes.

A state, political subdivision, agency or authority that borrows money through the sale of bonds or notes.

ISSUED SHARE CAPITAL :

This is the total number of shares a company has made publicly available multiplied by the total nominal value of the shares. A company may have 10 million shares in issue, each with a nominal value of Re. 1. So the issued share capital is Rs. 10 million.

This is the total number of shares a company has made publicly available multiplied by the total nominal value of the shares. A company may have 10 million shares in issue, each with a nominal value of Re. 1. So the issued share capital is Rs. 10 million.

JUNK BOND :

A speculative bond with higher credit risk.

A speculative bond with higher credit risk.

KYC :

Know your Customer or KYC details are a must to start any financial transaction with a mutual fund, bank account, broker account, etc. SEBI has mandated a common KYC for all capital market entities so that investors do not have multiple procedures across entities.

Know your Customer or KYC details are a must to start any financial transaction with a mutual fund, bank account, broker account, etc. SEBI has mandated a common KYC for all capital market entities so that investors do not have multiple procedures across entities.

LAUNCH DATE :

The date on which a scheme is first made open to the public for subscription.

The date on which a scheme is first made open to the public for subscription.

LESSEE :

The person who makes lease payments. He has right of possession and use of a property under the terms of a lease.

The person who makes lease payments. He has right of possession and use of a property under the terms of a lease.

LESSOR :

The person who receives lease payments. He leases property.

The person who receives lease payments. He leases property.

LIBOR :

LIBOR stands for London Inter Bank Offer Rate. It's the rate of interest at which banks offer to lend money to one another in the so-called wholesale money markets in the City of London. Money can be borrowed overnight or for a period of in excess of five years. The most often quoted rate is for three month money. '3 month LIBOR' tends to be used as a yardstick for lenders involved in high value transactions. They tend to quote rates as 'points above LIBOR'. So if 3 month LIBOR were (say) six per cent, a bank may choose to lend to another bank at (say) 6 and a quarter per cent. e.g. a quarter per cent above 3 month LIBOR.

LIBOR stands for London Inter Bank Offer Rate. It's the rate of interest at which banks offer to lend money to one another in the so-called wholesale money markets in the City of London. Money can be borrowed overnight or for a period of in excess of five years. The most often quoted rate is for three month money. '3 month LIBOR' tends to be used as a yardstick for lenders involved in high value transactions. They tend to quote rates as 'points above LIBOR'. So if 3 month LIBOR were (say) six per cent, a bank may choose to lend to another bank at (say) 6 and a quarter per cent. e.g. a quarter per cent above 3 month LIBOR.

LIEN :

A type of security instrument (i.e., a tax lien), placed against property, making it security for the payment of a debt, judgment, mortgage, or taxes. If the lien is not paid, the lien holder has the right to confiscate the property in order to recover the money that was loaned.

A type of security instrument (i.e., a tax lien), placed against property, making it security for the payment of a debt, judgment, mortgage, or taxes. If the lien is not paid, the lien holder has the right to confiscate the property in order to recover the money that was loaned.

LIQUIDITY :

The ability to buy or sell an asset quickly or the ability to convert to cash quickly.

The ability to buy or sell an asset quickly or the ability to convert to cash quickly.

LIQUID FUNDS /MONEY MARKET FUNDS

:

Funds investing only in short-term money market instruments including treasury bills, commercial paper and certificates of deposit. The objective is to provide liquidity and preserve the capital.

Funds investing only in short-term money market instruments including treasury bills, commercial paper and certificates of deposit. The objective is to provide liquidity and preserve the capital.

LOAD :

A charge that may be levied as a percentage of NAV at the time of entry into the Scheme/Plans or at the time of exiting from the Scheme/Plans.

A charge that may be levied as a percentage of NAV at the time of entry into the Scheme/Plans or at the time of exiting from the Scheme/Plans.

LOCAL CHEQUE :

A Cheque handled locally and drawn on any bank, which is a member of the banker's clearing house located at the place where the application form is submitted.

A Cheque handled locally and drawn on any bank, which is a member of the banker's clearing house located at the place where the application form is submitted.

LOCK IN PERIOD :

The period after investment in fresh units during which the investor cannot redeem the units.

The period after investment in fresh units during which the investor cannot redeem the units.

MANAGEMENT FEE :

Money paid by a mutual fund to its investment manager or advisor for overseeing the portfolio. A management fee is usually between one-half and one percent of the fund's net asset value.

Money paid by a mutual fund to its investment manager or advisor for overseeing the portfolio. A management fee is usually between one-half and one percent of the fund's net asset value.

MARKET :

A public place where the buying and selling of all types of bonds, stocks and other securities takes place. A stock exchange is a market.

A public place where the buying and selling of all types of bonds, stocks and other securities takes place. A stock exchange is a market.

MARKET PRICE :

The price at which the units of a scheme are quoted on a stock exchange.

The price at which the units of a scheme are quoted on a stock exchange.

MARKET RISK :

The risk that the price of a security will rise or fall due to changing economic, political, or market conditions, or due to a company's individual situation.

The risk that the price of a security will rise or fall due to changing economic, political, or market conditions, or due to a company's individual situation.

MARKETABLITY :

The ease or difficulty with which securities can be sold in the market.

The ease or difficulty with which securities can be sold in the market.

MATURITY OR MATURITY DATE :

The date upon which the principal of a security becomes due and payable to the security holder.

The date upon which the principal of a security becomes due and payable to the security holder.

MATURITY VALUE :

The amount (other than periodic interest payment) that will be received at the time a security is redeemed at its maturity. On most securities the maturity value equals the par value.

The amount (other than periodic interest payment) that will be received at the time a security is redeemed at its maturity. On most securities the maturity value equals the par value.

MINIMUM ADDITIONAL INVESTMENT :

The minimum amount, which an existing investor should invest for purchasing fresh units.

The minimum amount, which an existing investor should invest for purchasing fresh units.

MINIMUM BALANCE :

Minimum amount specified by a fund that should remain invested in a scheme after any redemption.

Minimum amount specified by a fund that should remain invested in a scheme after any redemption.

MINIMUM SUBSCRIPTION :

The minimum amount required to be invested to purchase units of a scheme of a mutual fund.

The minimum amount required to be invested to purchase units of a scheme of a mutual fund.

MINIMUM WITHDRAWAL :

The smallest sum that an investor can withdraw (get redeemed) from the fund at one time.

The smallest sum that an investor can withdraw (get redeemed) from the fund at one time.

MONEY MARKET FUND :

A mutual fund that aims to pay money market interest rates. This is accomplished by investing in safe, highly liquid securities, including certificates of deposit, commercial paper, and Government securities. Money funds make these high interest securities available to the average investor seeking immediate income and high investment safety.

A mutual fund that aims to pay money market interest rates. This is accomplished by investing in safe, highly liquid securities, including certificates of deposit, commercial paper, and Government securities. Money funds make these high interest securities available to the average investor seeking immediate income and high investment safety.

MONEY MARKET INSTRUMENTS :

Commercial paper, treasury bills, GOI securities with an unexpired maturity up to one year, call money, certificates of deposit and any other instrument specified by the Reserve Bank of India.

Commercial paper, treasury bills, GOI securities with an unexpired maturity up to one year, call money, certificates of deposit and any other instrument specified by the Reserve Bank of India.

MORTGAGE :

A legal instrument given by a borrower to the lender entitling the lender to take over pledged property if conditions of the loan are not met.

A legal instrument given by a borrower to the lender entitling the lender to take over pledged property if conditions of the loan are not met.

MOVING AVERAGES :

The average price of a mutual fund calculated periodically over some designated period of time and plotted on a chart against actual price. The effect of a moving average is to minimize short-term price fluctuations and highlight long-term price fluctuations.

The average price of a mutual fund calculated periodically over some designated period of time and plotted on a chart against actual price. The effect of a moving average is to minimize short-term price fluctuations and highlight long-term price fluctuations.

MUTUAL FUND :

An investment that pools shareholders money and invests it toward a specified goal. The funds are invested by a professional investment manager usually called the AMC ( Asset Management Company).

An investment that pools shareholders money and invests it toward a specified goal. The funds are invested by a professional investment manager usually called the AMC ( Asset Management Company).

MUTUAL FUND REGULATIONS :

Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 as amended up to date and such other Regulations, as may be in force from time to time, to regulate the activities of the Mutual Fund.

Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 as amended up to date and such other Regulations, as may be in force from time to time, to regulate the activities of the Mutual Fund.

NO-LOAD SCHEME :

A Scheme where there is no initial Entry or Exit Load.

A Scheme where there is no initial Entry or Exit Load.

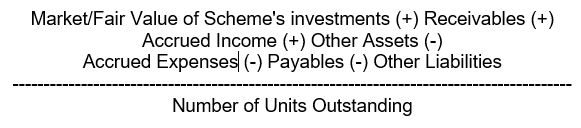

NAV :

Net Asset Value of the Units in each plan of the Scheme is calculated in the manner provided in this Offer Document or as may be prescribed by Regulations from time to time. The NAV will be computed upto four decimal places. NAV Formula :

Net Asset Value of the Units in each plan of the Scheme is calculated in the manner provided in this Offer Document or as may be prescribed by Regulations from time to time. The NAV will be computed upto four decimal places. NAV Formula :

NAV CHANGE :

The difference between today's closing net asset value (NAV) and the previous day's closing net asset value (NAV).

The difference between today's closing net asset value (NAV) and the previous day's closing net asset value (NAV).

NAV CHANGE % :

The percentage change between today's closing net asset value (NAV) and the previous day's closing net asset value (NAV)

The percentage change between today's closing net asset value (NAV) and the previous day's closing net asset value (NAV)

NET WORTH :

A person's net worth is equal to the total value of all possessions, such as a house, stocks, bonds, and other securities, minus all outstanding debts, such as mortgage and revolving credit lines.

A person's net worth is equal to the total value of all possessions, such as a house, stocks, bonds, and other securities, minus all outstanding debts, such as mortgage and revolving credit lines.

NET YIELD :

Rate of return on a security net of out-of-pocket costs associated with its purchase, such as commissions or markups.

Rate of return on a security net of out-of-pocket costs associated with its purchase, such as commissions or markups.

NON PERFORMING INVESTMENTS :

Part of the portfolio investment of a debt fund which is not making interest payment or principal amount repayments in time.

Part of the portfolio investment of a debt fund which is not making interest payment or principal amount repayments in time.

NIFTY :

An index of prices of a group of fifty stocks listed on the NSE.

An index of prices of a group of fifty stocks listed on the NSE.

NRI :

Non-Resident Indian.

Non-Resident Indian.

OCB :

extent of at least 60% by NRls and trusts in which at least 60% of the beneficial interest is held irrevocably by NRls.

extent of at least 60% by NRls and trusts in which at least 60% of the beneficial interest is held irrevocably by NRls.

OFFER DOCUMENT OR PROSPECTUS :

The official document issued by mutual funds prior to the launch of a fund describing the characteristics of the proposed fund to all its prospective investors. It contains information required by the Securities and Exchange Board of India, such as investment objective and policies, services, and fees. Individual investors are encouraged to read and understand the fund's prospectus.

The official document issued by mutual funds prior to the launch of a fund describing the characteristics of the proposed fund to all its prospective investors. It contains information required by the Securities and Exchange Board of India, such as investment objective and policies, services, and fees. Individual investors are encouraged to read and understand the fund's prospectus.

OFFERING PERIOD :

The period during which the initial offer to subscribe for the units of a scheme is open.

The period during which the initial offer to subscribe for the units of a scheme is open.

OFFER PRICE :

The lowest price that a seller is willing to accept from a prospective buyer. In the case of a mutual fund with a sales charge, this price is the net asset value (NAV) plus the sales charge. In the case of no-load funds, it is the NAV.

The lowest price that a seller is willing to accept from a prospective buyer. In the case of a mutual fund with a sales charge, this price is the net asset value (NAV) plus the sales charge. In the case of no-load funds, it is the NAV.

OFFERING DATE :

The date on which a distribution of stocks or bonds will first be available to the public.

The date on which a distribution of stocks or bonds will first be available to the public.

OPEN-ENDED SCHEMES/ FUNDS :

A fund whose units are redeemable at any time at asset value, Except for funds that no longer accept new unitholder, new units are offered continuously.

A fund whose units are redeemable at any time at asset value, Except for funds that no longer accept new unitholder, new units are offered continuously.

OPENING NAV :

The NAV disclosed by the fund for the first time after the closure of an IPO.

The NAV disclosed by the fund for the first time after the closure of an IPO.

OPTION :

A device used to speculate or hedge in securities markets. Buying a "call" option gives an investor the right to buy 100 shares of a stock at a certain price within a specified time; buying a "put" option allows an investor to sell a stock under the same conditions.

A device used to speculate or hedge in securities markets. Buying a "call" option gives an investor the right to buy 100 shares of a stock at a certain price within a specified time; buying a "put" option allows an investor to sell a stock under the same conditions.

OPPORTUNITY RISK :

The risk that a better opportunity may present itself after you have already committed your money elsewhere.

The risk that a better opportunity may present itself after you have already committed your money elsewhere.

PLANS :

The Scheme offers five Plans, Growth Plan and four Dividend Plans viz. Monthly, quarterly, Half Yearly and Annual Dividend Plans.

The Scheme offers five Plans, Growth Plan and four Dividend Plans viz. Monthly, quarterly, Half Yearly and Annual Dividend Plans.

PIO :

Person of Indian Origin

Person of Indian Origin

PORTFOLIO :

The list of securities owned by the mutual fund. This list may be long, for example, Fidelity Magellan, with over 2000 stocks, or relatively short, for example, Sequoia, with only 16 stocks.

The list of securities owned by the mutual fund. This list may be long, for example, Fidelity Magellan, with over 2000 stocks, or relatively short, for example, Sequoia, with only 16 stocks.

PORTFOLIO CHURNING :

Switches between different stocks in the market, keeping in view the market conditions, in order to give unit holders a better yield.

Switches between different stocks in the market, keeping in view the market conditions, in order to give unit holders a better yield.

PREMIUM :

The amount by which a bond/ or a stock (in case of a IPO) sells above its par (face) value.

The amount by which a bond/ or a stock (in case of a IPO) sells above its par (face) value.

PRICE OF UNITS :

Price offered by a mutual fund for repurchase or sale of a unit on a daily basis. Price/Earnings Ratio This is the price of a stock divided by its earnings per share. This ratio gives an investor an idea of how much they are paying for a particular company's earning power. A trailing P/E refers to a ratio that is based on earnings from the latest year, while a forward P/E uses an analyst's forecast of next year's earnings. For instance, a stock selling for Rs. 20 a share that earned Re. 1 last year has a trailing P/E of 20. If the same stock has projected earnings of Rs. 2 next year, then it has a forward P/E of 10.

Price offered by a mutual fund for repurchase or sale of a unit on a daily basis. Price/Earnings Ratio This is the price of a stock divided by its earnings per share. This ratio gives an investor an idea of how much they are paying for a particular company's earning power. A trailing P/E refers to a ratio that is based on earnings from the latest year, while a forward P/E uses an analyst's forecast of next year's earnings. For instance, a stock selling for Rs. 20 a share that earned Re. 1 last year has a trailing P/E of 20. If the same stock has projected earnings of Rs. 2 next year, then it has a forward P/E of 10.

PRICE STABILITY :

Price stability protects the original amount you put into an investment. A mutual fund's price stability is seen in changes in its net asset value over time.

Price stability protects the original amount you put into an investment. A mutual fund's price stability is seen in changes in its net asset value over time.

PRIMARY MARKET(NEW ISSUE MARKET)

:

The market on which newly issued securities are sold, including government security auctions and underwriting purchases of blocks of new issues, which are then resold.

The market on which newly issued securities are sold, including government security auctions and underwriting purchases of blocks of new issues, which are then resold.

PROSPECTUS :

An official document that each investment company must publish, describing the mutual fund and offering its shares for sale. It contains information that has been mandatorily required by SEBI.

An official document that each investment company must publish, describing the mutual fund and offering its shares for sale. It contains information that has been mandatorily required by SEBI.

PURCHASE PRICE :

Purchase Price to the investor of Units of any of the plans computed in the manner indicated in this Offer Document.

Purchase Price to the investor of Units of any of the plans computed in the manner indicated in this Offer Document.

RATE OF RETURN :

The total proceeds derived from the investment per rupee initially invested. Proceeds must be defined broadly to include both cash distributions and capital gains. The rate of return is expressed as a percentage.

The total proceeds derived from the investment per rupee initially invested. Proceeds must be defined broadly to include both cash distributions and capital gains. The rate of return is expressed as a percentage.

RATINGS :

Designations given by credit rating agencies indicating relative credit quality as compared to other funds

Designations given by credit rating agencies indicating relative credit quality as compared to other funds

RECORD DATE :

The date the fund determines who its unitholders are; "unitholders of record" who will receive the fund's income dividend and/or net capital gains distribution.

The date the fund determines who its unitholders are; "unitholders of record" who will receive the fund's income dividend and/or net capital gains distribution.

REDEMPTION :

The paying off or buying back of units of a mutual fund / bond by the issuer.

The paying off or buying back of units of a mutual fund / bond by the issuer.

REDEMPTION FEE :

A fee charged by a limited number of funds for redeeming, or buying back, fund units.

A fee charged by a limited number of funds for redeeming, or buying back, fund units.

REDEMPTION PRICE :

The price at which a mutual fund's units are redeemed (bought back) by the fund. The redemption price is usually equal to the current NAV per unit.

The price at which a mutual fund's units are redeemed (bought back) by the fund. The redemption price is usually equal to the current NAV per unit.

REFUND :

The act of returning money to an investor by the fund. This could be on account of rejection of an application to subscribe units or in response to an application made by the investor to the fund to redeem units held by him.

The act of returning money to an investor by the fund. This could be on account of rejection of an application to subscribe units or in response to an application made by the investor to the fund to redeem units held by him.

REGISTRAR / KARVY :

Karvy Consultants Ltd., who have been appointed as the Registrar.

Karvy Consultants Ltd., who have been appointed as the Registrar.

REINVESTMENT DATE :

The date on which a share's dividend and/or capital gains will be reinvested (if requested) in additional fund shares.

The date on which a share's dividend and/or capital gains will be reinvested (if requested) in additional fund shares.

REINVESTMENT PRIVILEGE :

A service that most mutual funds offer whereby a shareholder's income dividends and capital gains distributions are automatically reinvested in additional shares. See Automatic Reinvestment.

A service that most mutual funds offer whereby a shareholder's income dividends and capital gains distributions are automatically reinvested in additional shares. See Automatic Reinvestment.

RELATIVE VOLATILITY :

A ratio of a portfolio's standard deviation to the standard deviation of a benchmark index. See Volatility Measures.

A ratio of a portfolio's standard deviation to the standard deviation of a benchmark index. See Volatility Measures.

REPATRIATION CONVERSION OF FOREIGN

CURRENCY TO AN INVESTOR'S BASE CURRENCY

:

Rupee-Cost-Averaging With rupee-cost-averaging, you invest a fixed amount on a regular basis - regardless of the current market trends. The investor buys more shares when the price is low and fewer shares when the price is high; the overall cost is lower than it would be if a constant number of shares were bought at set intervals. Rupee-cost-averaging does not assure a profit or protect against a loss in a declining market. You must continue to purchase shares both in market ups and downs. The goal of rupee-cost-averaging is to attain a lower average cost per share.

Rupee-Cost-Averaging With rupee-cost-averaging, you invest a fixed amount on a regular basis - regardless of the current market trends. The investor buys more shares when the price is low and fewer shares when the price is high; the overall cost is lower than it would be if a constant number of shares were bought at set intervals. Rupee-cost-averaging does not assure a profit or protect against a loss in a declining market. You must continue to purchase shares both in market ups and downs. The goal of rupee-cost-averaging is to attain a lower average cost per share.

REPO :

Sale of Securities with simultaneous agreement to repurchase them at a later date.

Sale of Securities with simultaneous agreement to repurchase them at a later date.

REPURCHASE :

Buying back/ cancellation of the units by a fund on an ongoing basis or for a specified period or on maturity of a scheme. The investor is paid a consideration linked to the NAV of the scheme.

Buying back/ cancellation of the units by a fund on an ongoing basis or for a specified period or on maturity of a scheme. The investor is paid a consideration linked to the NAV of the scheme.

REPURCHASE DATE /PERIOD :

In the case of close-ended schemes, the specified date on which or period during which the investor can redeem units held by him in the scheme before the maturity of the scheme.

In the case of close-ended schemes, the specified date on which or period during which the investor can redeem units held by him in the scheme before the maturity of the scheme.

REPURCHASE PRICE :

The price of a unit (net of exit load) that the fund offers the investor to redeem his investment.

The price of a unit (net of exit load) that the fund offers the investor to redeem his investment.

RETURNS :

The dividend and capital appreciation accruing to the investor on the investment held by him.

The dividend and capital appreciation accruing to the investor on the investment held by him.

REVERSE REPO :

Purchase of securities with simultaneous agreement to sell them at a later date.

Purchase of securities with simultaneous agreement to sell them at a later date.

RISK ADJUSTED RETURNS :

Generally, the expected returns from an investment are dependent on the risk involved in the investment. For the purpose of comparing returns from investments involving varying levels of risk, the returns are adjusted for the level of risk before comparison. Such returns (reduced for the level of risk involved) are called risk-adjusted returns.

Generally, the expected returns from an investment are dependent on the risk involved in the investment. For the purpose of comparing returns from investments involving varying levels of risk, the returns are adjusted for the level of risk before comparison. Such returns (reduced for the level of risk involved) are called risk-adjusted returns.

SAPs :

Special Purpose Vehicles approved by the appropriate authority or the Government of India.

Special Purpose Vehicles approved by the appropriate authority or the Government of India.

SALE PRICE :

The price at which a fund offers to sell one unit of its scheme to investors. This NAV is grossed up with the entry load applicable, if any.

The price at which a fund offers to sell one unit of its scheme to investors. This NAV is grossed up with the entry load applicable, if any.

SALES CHARGE :